Reshaping Financial Content: Enhancing Consumer Appreciation in Australian Professional Practice

Published 24 October, 2023

The by-product of financial advice, known as a Statement of Advice (SOA), serves as a written documentation of financial guidance provided to consumers. Its primary purpose is to ensure accountability for regulatory compliance and consumer protection, as outlined in the Corporations Act (2001) of Australia. However, due to the intricate nature of mandatory disclosure requirements, SOA documents tend to be extensive and pose challenges in both their creation and comprehension by consumers. Indeed, recent studies have indicated a decline in the recording of consumer relationships within the Australian financial practice.

These limitations prompted Ben Neilson from the University of Southern Queensland to investigate the impact of these laborious documents on consumer appreciation, focusing on the key pillars of comprehension, value, and trust.

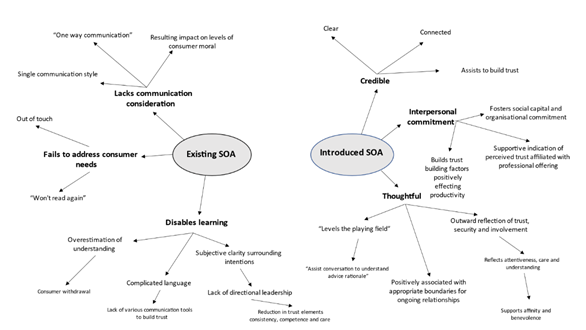

Neilson initially collected data to assess consumer appreciation levels of the current SOA financial content structure. This data was gathered through a combination of qualitative interviews and quantitative analysis.

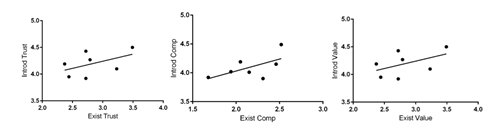

With this valuable data in hand, the researcher introduced a reimagined financial content structure that incorporated language improvements, explanatory videos, and hyperlinks. Subsequently, the impact of this new structure on consumer appreciation was evaluated and compared to the existing structure using a combination of thematic analysis, MANOVA, and econometric modeling.

“The findings revealed that the structure of financial content significantly influences consumer appreciation, particularly with respect to clarity, organization, and formatting, all of which play pivotal roles in shaping decision-making processes,” shared Neilson. “Notably, our restructured financial content received higher levels of consumer appreciation, suggesting the potential for a shift in Australian professional practice.”

The study, published in The Journal of Finance and Data Science, provides evidence that may contribute to debates surrounding consumer serviceability, relationship quality, and content structure of SOA documents in the Australian landscape. This may potentially encourage a redesign of the SOA content structure.

Contact author name, affiliation, email address: Ben Neilson, University of Southern Queensland, PO Box 8010, Bargara, QLD 4670, Australia, ben@neilsonwealth.com.au

Conflict of interest: The author declares that this research took reasonable steps to avoid conflict or competing interests. The author did not receive support from any organization for the submitted work. The author has no competing interests to declare relevant to this article's content.

See the article: Ben Neilson, Investigating the impact financial content structure has on consumer appreciation: An empirical study of Australian statement of advice documents, The Journal of Finance and Data Science, Volume 9, 2023, 100103. https://doi.org/10.1016/j.jfds.2023.100103