Monitoring system detects anti‑money laundering news for banks

Published 12 October, 2025

Investigative journalism often surfaces financial misconduct before regulators can react. However, manual news tracking is slow and error‑prone. In a new study published in Risk Sciences, a team of researchers introduces a data‑driven media monitoring system that transforms Belgian print news into early‑warning signals for anti‑money laundering (AML) supervision of financial institutions.

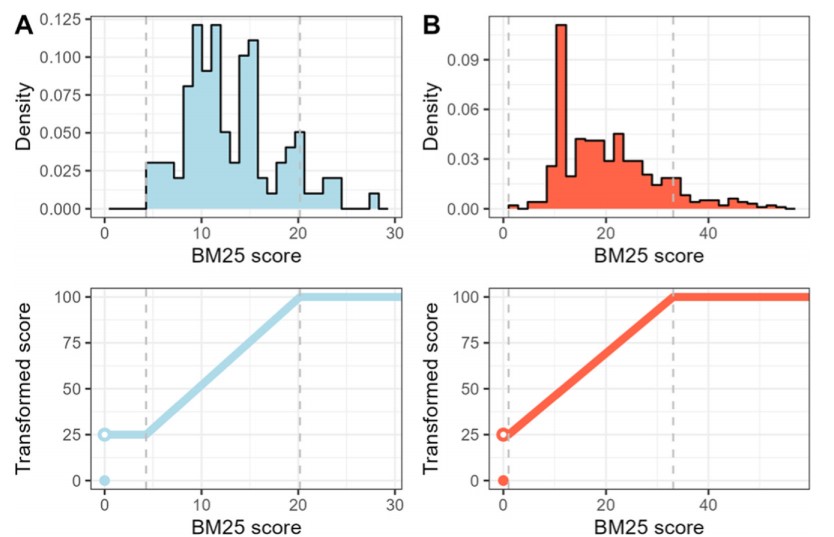

The pipeline ingests articles via the BelgaPress API and computes two relevant dimensions per article: entity relevance (“does the article focus on a specific supervised institution?”) and thematic AML relevance (“is the content AML‑related?”). Both rely on BM25 scoring with calibrated transformations; overall article relevance is the geometric mean of entity and thematic scores.

“A period‑level AML signal then aggregates top‑ranked articles using a geometric weighting scheme; a rule‑of‑thumb threshold of 75 triggers analyst review,” explains corresponding author Pascal Ringoot. “Post‑processing with named entity recognition, lemmatization, and dependency parsing reduces false positives by enforcing co‑occurrence of institution mentions and AML keywords within sentences or short paragraphs.”

Applied to Belgian banks, the system highlights three International Consortium of Investigative Journalists (ICIJ) events—Offshore Leaks (2013), Panama Papers (2016) and FinCEN Files (2020)—as having prominent, AML‑relevant coverage. Event‑window counts show attention spikes on and after release dates, with follow‑on articles adding new details or policy responses. Robustness checks indicate the approach remains informative under machine translation and provide a comparison with a prompt‑based large language model method.

“However, while prompts handle multilingual content well, they are costlier, less transparent, and face licensing constraints,” says Ringoot. “Qualitative expert judgement remains essential to interpret alerts and adjust AML risk assessments.”

Contact author:

Pascal Ringoot, Faculty of Social Sciences and Solvay Business School, Vrije Universiteit Brussel (VUB), Belgium

Email: pascal.ringoot@nbb.be; pascal.ringoot@vub.be

Kris Boudt, Faculty of Social Sciences and Solvay Business School, Vrije Universiteit Brussel, Belgium Department of Economics, Ghent University, Belgium School of Business and Economics, Vrije Universiteit Amsterdam, the Netherlands

Olivier Delmarcelle, Faculty of Social Sciences and Solvay Business School, Vrije Universiteit Brussel, Belgium Department of Economics, Ghent University, Belgium

Funder:

This work was supported by the Research Foundation Flanders (#G014420N, #W001021N) and the COST action (#CA21163) on Text, functional and other high-dimensional data in econometrics.

Conflict of interest:

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

See the article:

https://doi.org/10.1016/j.risk.2025.100018