The progress and value of digital transformation of commercial banks in China

Published 28 April, 2023

In recent years, digital technologies like big data, artificial intelligence and cloud computing have prompted transformation in many industries. The financial sector has been no exception, introducing novel services like digital payment, BigTech lending and robo-advisors. Although the technology entrants may led the transformation in the early years, commercial banks have become the major participants by taking the advantage of digital technologies to stay competitive and offer improved customer services.

In 2020, the total investment of Chinese banks in financial technology reached CNY 207.8 billion, a 20% increase over 2019. Notably, some banks invested more than 4% of their revenues in technology, with the six largest banks invested CNY 116.5 billion in financial technology in 2022, an increase of 8.42% from 2021.

In a study published in KeAi journal China Economic Quarterly International, researchers in China constructed an index system to quantitatively measure digital transformation of commercial banks in the country. Study authors Xuanli Xie and Shihui Wang from the National School of Development, and Institute of Digital Finance, Peking University, present the trend and characteristics of digital transformation of commercial banks in China, as well as empirically test the impact of digital transformation on bank performance and competitiveness.

“The index system of digital transformation consists of three dimensions: strategy transformation, business transformation and management transformation. Strategy transformation refers to banks’ strategic attention to digital technology, which is measured by the frequency of keywords related to digital technology in annual reports of banks. Business transformation focuses on the degree of integrating digital technology into banks’ financial services. Management transformation focuses on the degree of integrating digital technology into governance structure and organizational management of banks,” explained Xie.

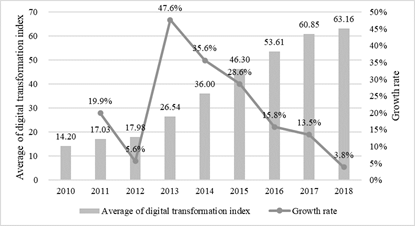

The annual average of digital transformation index of 221 sampled commercial banks in China increased from 14.20 in 2010 to 63.16 in 2018, rising year by year, though the growth rate declined gradually. “Although digital transformation of banks does not directly improve the overall performance of banks, it enhances the profitability of deposit and loan business and bank efficiency,” added Xie. “More importantly, digital transformation of banks can reduce the competitive pressure from new technology entrants. Also, bank digital transformation accelerates the exit of offline channels.”

The study results further underscored the importance of digital transformation for banks to gain competitive advantage and succeed in the digital era.

“Our index system of digital transformation of banks enables quantitative measurement of digital transformation of banks and has high generalizability for digital transformation in other industries. said Wang. “The empirical analyses of the impact of digital transformation on bank performance also shows the value of digital transformation, which provides supporting evidence for relevant policies.”

Image: Average combined index of digital transformation of banks and its growth rate in 2010–2018

CREDIT: Xuanli Xie and Shihui Wang.

Contact author details: Xuanli Xie, xxl@nsd.pku.edu.cn

## The data of Peking University digital transformation index of commercial banks in China are available upon request (xxl@nsd.pku.edu.cn).

See the article: Xuanli Xie, Shihui Wang, Digital transformation of commercial banks in China: Measurement, progress and impact, China Economic Quarterly International, Volume 3, Issue 1, 2023, Pages 35-45, ISSN 2666-9331.